How Much Does College Cost in Canada?

In This Article

If you’re thinking about going to school, you may be wondering the big question: how much does college cost in Canada? If you find this thought crosses your mind, you aren’t the only one.

We’ve done the research to give you a good idea of what you can expect to pay for a college education in Canada. We’ll break down everything from tuition and textbooks to accommodations, transportation and technology.

We are here to help make your college experience the best it can be so you’re set up to succeed as you start your career. Part of that preparation is making sure you’re financially ready, so let’s get into it!

Tuition is likely going to be the largest expense you encounter throughout your college years. We went to Statistics Canada for the full details.

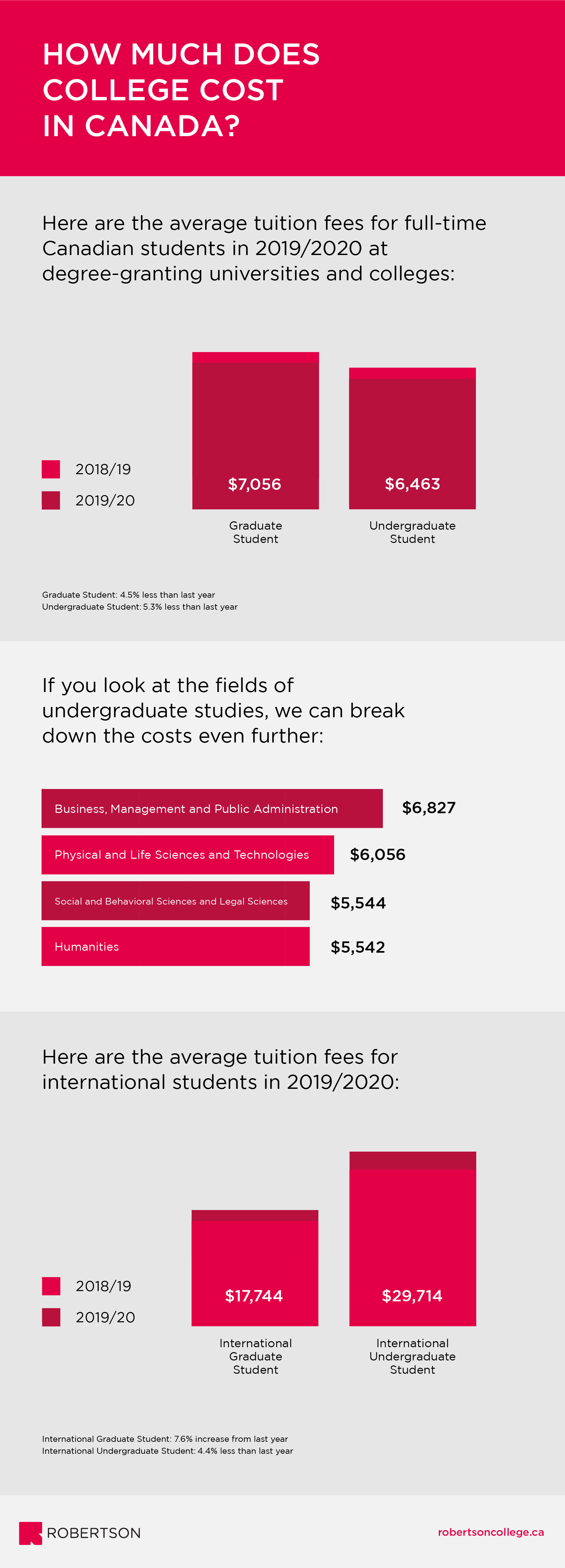

Here are the average tuition fees for full-time Canadian students in 2019/2020 at degree-granting universities and colleges:

If you look at the fields of undergraduate studies, we can break down the average costs even further:

Humanities: $5,542

Social and Behavioural Sciences and Legal Sciences: $5,544

Business, Management and Public Administration: $6,827

Physical and Life Sciences and Technologies: $6,056

Using Statistics Canada’s chart documenting undergraduate tuition fees for full-time Canadian students by province, here is the average tuition across all the fields listed above:

Newfoundland and Labrador: ~$2,716

Prince Edward Island: ~$6,270

Nova Scotia: ~$7,710

New Brunswick: ~$7,540

Quebec: ~$3,405

Ontario: ~$7,132

Manitoba: ~$4,196

Saskatchewan: ~$6,887

Alberta: ~$5,347

British Columbia: ~$5,392

Statistics Canada did not have data on the Yukon, Northwest Territories or Nunavut.

Here are the average tuition fees for international students in 2019/2020:

As you can see, it’s a lot more expensive for international students to study in Canada, though there are plenty of financial supports available to remove some of the burden.

You’ll likely have to spend an average of $500 per year on textbooks at most universities or colleges in Canada. However, textbook costs can range anywhere from $300 to upwards of $1,000, depending on the program you’re taking.

Along with books, you’ll need your study supplies. Notebooks, papers, pens, binders and planners are all more of the “essential” school supplies we’ve come to know and use to keep track of our assignments. The prices on these items range significantly but we recommend putting away $100-$200 for these types of supplies. You may not need to use everything you’ve budgeted for but it’ll give you that flexibility.

If you’re commuting to college, you’re going to have to get there somehow! If you opt for the bus, you should plan to pay anywhere between $85 to $150 per month. The cost of a monthly bus pass varies by city so you’ll have to consult the transit website for yours. A place you can start is MTL Blog’s list of estimated bus pass costs in major Canadian cities.

If you drive, you’ll have to account for gas. Statistics Canada breaks down the monthly average retail price of gasoline in the provinces so you can find information on your province there. The cost for gas will depend on the vehicle you drive, how far you have to commute and how often. It will truly be different for everyone, but you could be looking at a couple hundred dollars per month for gas.

On top of that, you’ll have to budget for car insurance which varies province to province. Canada Drives breaks down the average car insurance rates across Canada and in most provinces, you’ll likely be paying over $1,000 per year.

Whether you’re still living at home or living in residence at your college, there will be a degree of expense to your living situation.

Numbeo, an online database of user-contributed data based on over 59,000 responses across Canada, has found the average cost of rental accommodations in Canada to be as follows:

If you choose to stay in residence, it could cost you anywhere from $3,000 to $10,000. Check with the college of your choice to see their rates as they differ across the provinces.

When you go to college, you’ll be spending money on tuition, textbooks and room and board—but don’t forget about yourself! If you like working out, factor a gym membership into your budget (they’re usually around $50 per month). If you like to socialize, put some money aside for eating out every once in a while. Depending on where you go, you could spend anywhere from $15 to $40 for a single meal, so it’s up to you to decide where to spend it.

If you’re renting a place while in college, chances are you’ll need WiFi to do work when you’re not on campus. Internet rates average around $75 per month, though check the internet provider in your province for rates and package options.

You may also need a new laptop for your college experience, which can cost thousands of dollars depending on the model and features you’re looking for. Do your research and see what fits your needs but don’t forget about this expense (because it can be a big one).

If you haven’t already realized, college is expensive. There are many costs you may not have thought of and most students don’t have thousands of dollars lying around to pay for their education. This is why the Government of Canada offers student aid, grants and loans to relieve some of the financial burdens of going to school. You also have the option of opening a line of credit with your financial institution.

Most student loans don’t charge interest until at least six months after graduation, which would give you the opportunity to save up before paying it off.

If you’d like help budgeting for college, you can use this college expenses calculator to estimate how much you’ll pay for your college experience.

At Robertson, we strive to offer a variety of financial aid opportunities to ease the stress of payments and allow you to focus on your studies. Our dedicated Financial Aid Officers will help you every step of the way, and you can find funding information for your here.

In This Article

Once you take the first step, one of our Student Admissions Advisors will get in touch to better understand your goals for the future.

Apply Now