How To Choose the Right Accounting Career Path [Salaries]

quick answer

Accounting career paths include professional designations such as CPA, as well as exciting options such as Forensic Accountant, Comptroller, or Actuary. You may also consider a role as a Bookkeeper or Accounting Assistant, which don’t require a Degree.

In This Article

What’s the first thing that comes to mind when you think of an Accountant? Probably math. Maybe someone you know who is an Accountant. But the word interesting may not be the first thing you think of. You would be wrong.

There are many accounting career paths to pursue, and all of them can provide an interesting and meaningful career. Not only that, but Accountants are one of the most in-demand jobs in Canada, with data showing that there are more jobs available than applicants to fill them.

Discover different accounting career paths, their qualifications and salaries, and how to choose the right path for you.

There are many types of accounting jobs. While some are more traditional, such as a CPA or Bookkeeper, there are also a number of exciting paths an Accountant may choose to take.

Depending on your specific interests, aspirations, and desired level of post-secondary education, here are some of the most popular accounting career options to pursue.

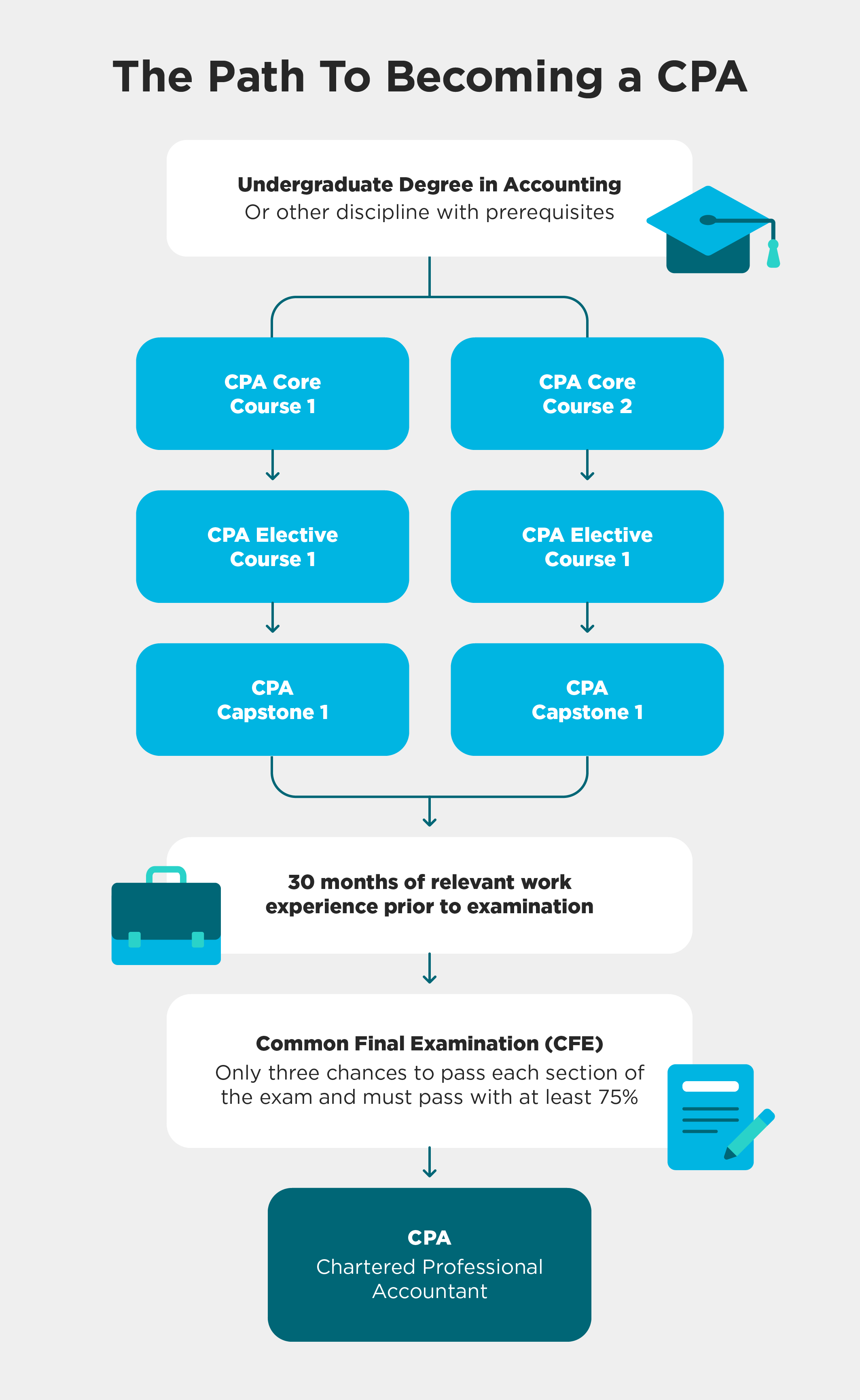

A Chartered Professional Accountant (CPA) is the specific designation the majority of accountants need in order to practice as an Accountant. A CPA is a certified and licensed Accountant who has passed the required courses and exam.

CPA career paths include any number of roles. They may choose to work privately for one company, overseeing finances and ensuring compliance, or they may choose a public accounting career path, such as working for the government or in an agency.

Required Education and Credentials:

As the name implies, Tax Accountants exclusively handle all matters related to taxes. They can work for companies, ensuring they follow all proper tax procedures for filing and getting maximum deductions and returns. They can also work independently or for a firm where they are hired by individual clients to help with their taxes.

Tax Accountants are generally busiest during tax season, which extends from January to April. The rest of the year, they help with budgeting, monitoring tax compliance, and recordkeeping, among other responsibilities.

Required Education: Minimum Bachelor’s Degree in a specialization such as Accounting or Finance

Generally hired by a company, a Bookkeeper helps manage and keep record of expenses. Bookkeeper duties primarily include tracking incoming and outgoing expenses, but they may also help with payroll, reporting, and invoicing.

The main difference between a Bookkeeper and an Accountant is that Bookkeepers track financial transactions, whereas an Accountant uses that data to help inform decision-making for the organization or individual.

Bookkeeping is a popular choice for those interested in Accounting, either as a stepping stone into another role or for individuals who don’t wish to pursue a Certification like CPA.

Required Education:

A popular and unique accounting career path is forensic accounting. This type of accounting focuses specifically on the analysis of financial records as it pertains to legal and criminal cases.

A typical forensic accounting career path can include government work, private sector work, law, or consulting. Forensic accounting requires extra attention to detail for examining evidence. People interested in forensic accounting should also not be averse to public speaking, as they may be required to testify in court.

Required Education:

Comptrollers oversee all financial operations for public organizations, such as for the government or non-profit organizations. They are typically part of the management or executive teams, reporting to the Chief Financial Officer (CFO) or working in place of a CFO at smaller companies.

Comptrollers handle accounting, financial reporting, risk management, and forecasting, among other responsibilities. As a senior position, it takes a minimum of five years to work up to the role of Comptroller.

Required Education:

This type of Accountant is employed by an organization to keep track of finances. They are responsible for sharing financial information with internal and external stakeholders to help them make informed financial decisions.

Financial Accountants may also be responsible for helping organizations make business decisions based on their understanding of the financial data. Financial Accountants will keep track of all financial transactions and report on the organization’s financial health.

Required Education:

Rather than working for a company or an individual, Investment Accountants work at brokerage firms where they are responsible for processing investments on behalf of the brokers and their clients.

An Investment Accountant provides financial advice while also monitoring investments and preparing tax reports. They need to have a very thorough understanding of the financial regulations in their area, as well as an eye for detail to maintain accurate records.

Required Education:

Also known as Corporate Accountants, Private Accountants are employed by a single company to manage their internal finances. Private Accountants tend to focus on one specific industry, as it allows them to build a wealth of valuable knowledge for their employer.

Private Accountants monitor expenses, keep financial records, and provide analysis and insights to help with financial decisions. They can work for any business in any industry.

Required Education:

Actuaries are responsible for coming up with financial models for risk assessment, usually at a finance or insurance firm. This is a great career option for those who genuinely enjoy numbers and statistics.

Actuaries specialize in specific areas, such as health care, insurance, or enterprise risk. It’s their job to gather and analyze financial data, develop analysis methods, and create reports around their findings.

Required Education:

These Accountants can work at the municipal, provincial, or federal level. Their job is to monitor government spending, help with budgets, and provide financial forecasts. The biggest responsibility of a Government Accountant is to ensure that the government body they work for is spending money ethically and according to regulations.

Government Accountants may also be hired to audit other organizations or help individuals with taxes.

Required Education:

Accounting Assistants help the accounting department within an organization with administrative tasks. They provide support with bookkeeping, budgeting, and financial records and reporting. Accounting Assistants can work in nearly any industry, as they offer valuable support.

An Accounting Assistant is considered an entry-level position, so it requires less education and experience than other accounting career paths. It’s a good option for those interested in a hybrid accounting, administrative, and customer support role.

Required Education:

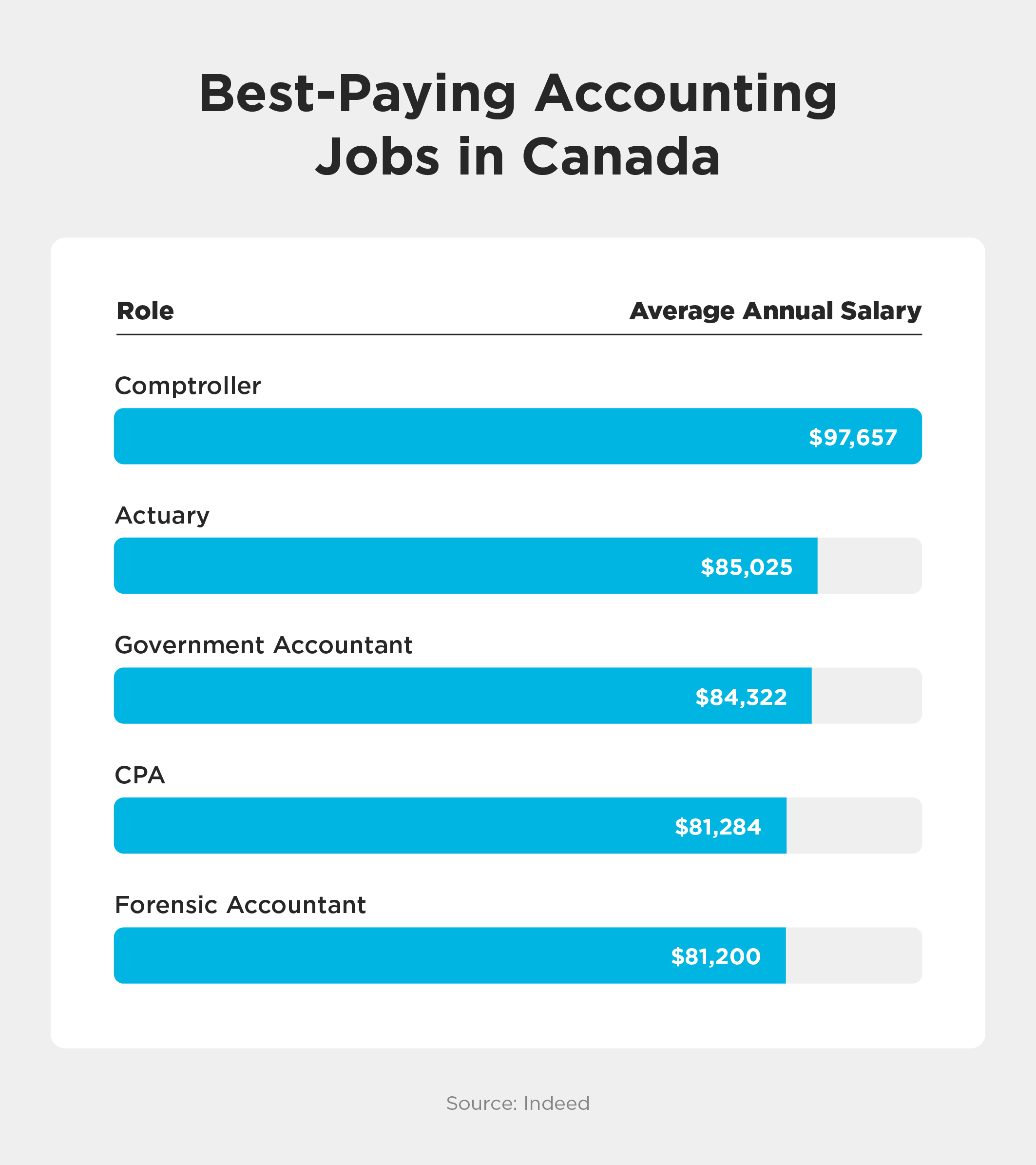

Jobs in the accounting field are some of the highest-paying jobs in Canada. The average salary for an Accountant is $69,458, but annual salaries can range from $35,012 to $97,657 and up. Salaries vary based on your experience and education, as well as how technical a role is. Here’s an overview of different salaries for Accountants.

| Average Accountant Salary by Role | |

|---|---|

| Role | Average Annual Salary |

| Comptroller | $97,657 |

| Actuary | $85,025 |

| Government Accountant | $84,322 |

| CPA | $81,284 |

| Forensic Accountant | $81,200 |

| Financial Accountant | $70,077 |

| Private Accountant | $62,493 |

| Tax Accountant | $62,409 |

| Bookkeeper | $52,864 |

| Investment Accountant | $51,695 |

| Accounting Assistant | $35,012 |

| Source: Indeed | |

Accountants have a wide range of responsibilities, which vary depending on their specific industry, organization, and role. Typically, accountants are responsible for keeping track of spending through records and reports, as well as interpreting data to help inform business decisions.

Depending on the specifics of the role, Accountants may attend meetings with their team or clients, present their findings, and work on projects collectively.

Here are some additional Accountant duties:

Along with an enthusiasm and aptitude for math, there are many skills an Accountant needs to be successful. Accountants should work well independently, have strong attention to detail, and be able to work under pressure and tight deadlines.

Here are some of the important skills Accountants should have:

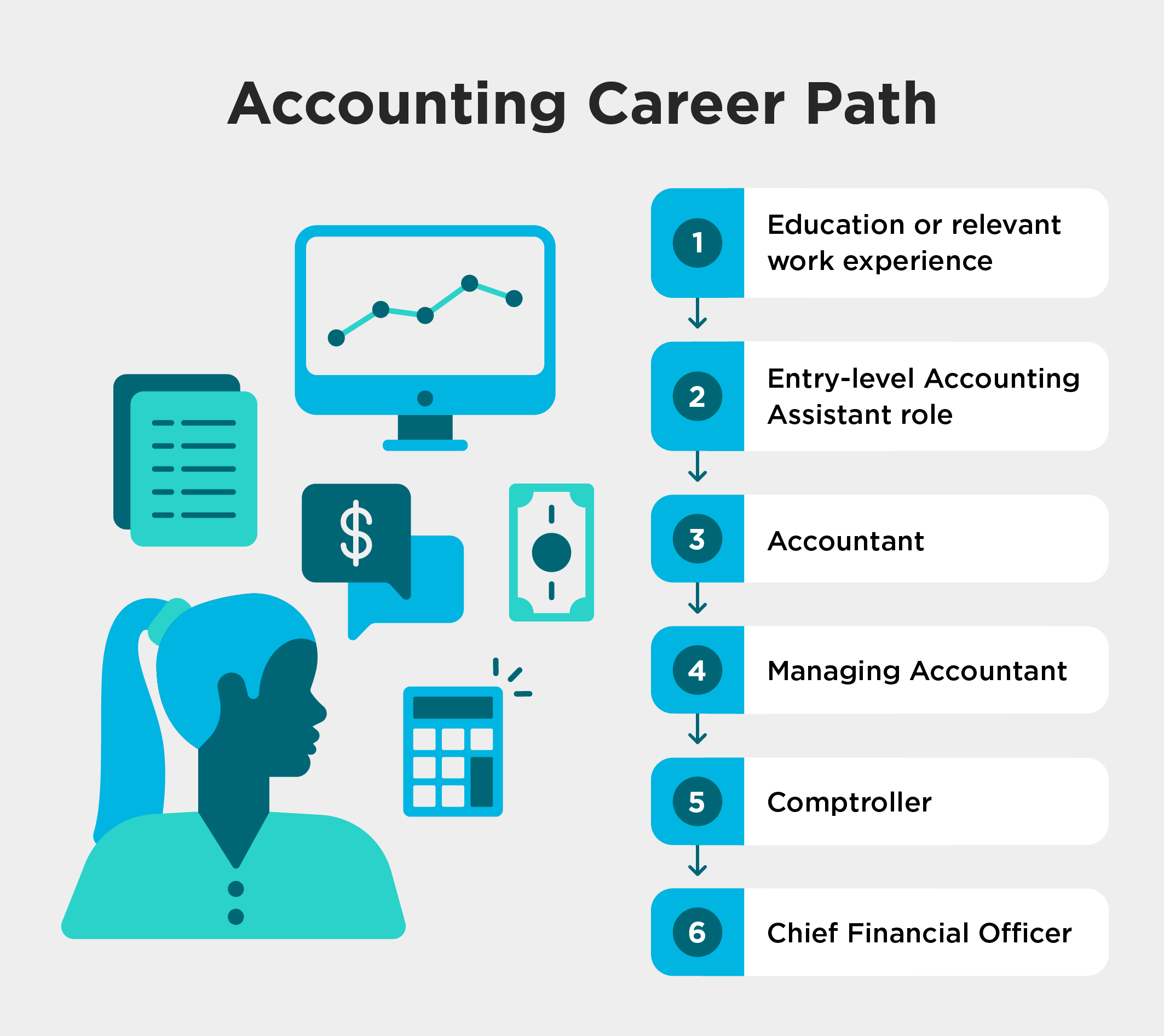

After completing an in-person or online education in accounting, such as a Bachelor’s Degree, Accounting Certification, or CPA Certification, an Accountant will start in an entry-level position. This can be in a government position, at an accounting firm, or within a company.

Based on their starting education and experience, the Accountant can then move up in seniority. This can include supervisor roles, management, and onwards to executive and even partner roles. Of course, this all depends on the individual’s specific career development plan. As with many senior positions, the more advanced an accounting career, the less actual accounting there will be as the role switches to more management and overseeing activities.

Accounting jobs can be broken down into four main fields: corporate, government, non-profit, and firm-based. Depending on your specific interests and competencies, each field has its pros and cons. Here’s an overview of the different accounting fields:

If you’re planning to pursue a post-secondary education in accounting, it’s important to know which accounting career paths are available to you. Some options include Degrees as well as shorter Certificate programs that will have you working in the accounting field sooner.

Learn more about Robertson’s Payroll and Accounting programs that will have you starting your career in accounting in as little as two years.

In This Article

Once you take the first step, one of our Student Admissions Advisors will get in touch to better understand your goals for the future.

Apply Now