Understanding Student Loan Forgiveness in Canada: What Are Your Options?

quick answer

Canada doesn’t have universal student loan forgiveness, but there are ways to pay less on your loans. Explore your options for student loan repayment here.

In This Article

In Canada, student loan debt is the norm.

There are over 1.7 million student borrowers in Canada — with the country’s total debt exceeding $18 billion.

With debt affecting student borrowers nationwide, it’s natural that borrowers would inquire about whether their loans can be forgiven — especially as other costs like credit card debt and mortgages start compounding after graduation.

Canada, however, does not offer universal student loan forgiveness. Unless you’re a medical professional who meets certain criteria, you’re not eligible for full loan forgiveness. But, while you’re not guaranteed total forgiveness on your student loan debt, there are different avenues you can take to reduce your loan payment.

Stay with us as we explore how student loan forgiveness works in Canada and how you can pay less on your loans.

Canada does not have universal student loan forgiveness. Unless you’re a medical professional working under certain conditions, you are not eligible to get your loans fully forgiven.

However, while student loans can’t fully be forgiven in Canada, there are many options to get relief on your loans on federal and provincial levels. In recent years, the federal government and provincial governments introduced programs and initiatives that can help levy the sometimes daunting amount of debt students face.

Keep reading as we explore different ways that borrowers can decrease their loan amount.

Certain health care professionals can qualify for student loan forgiveness in Canada, but you must meet specific criteria.

In order to be eligible for forgiveness, you must:

Medical professionals who may be eligible for student loans include:

If you’re eligible for student loan forgiveness, you can access an application here.

For borrowers who aren’t medical professionals, there are still options to pay less on your loan amount. Here are three ways you can reduce your loan amount:

Administered by the National Student Loan Centre, the Student Loan Repayment Assistance Plan (RAP) adjusts monthly payment amounts by gross family income. Individuals with higher family incomes receive less of a reduction and vice versa.

Under RAP, the federal government pays interest on your student loans for the first five years after you graduate, but you’ll be responsible for paying your adjusted principal amount. If you remain on RAP for the full five years, the government will begin paying both your principal and interest amount for the remainder of your time in the program.

Additionally, under RAP, if you pay your debt for 10 consecutive years, the government will pay off your loans for the remaining five years.

In order to qualify for RAP, you must:

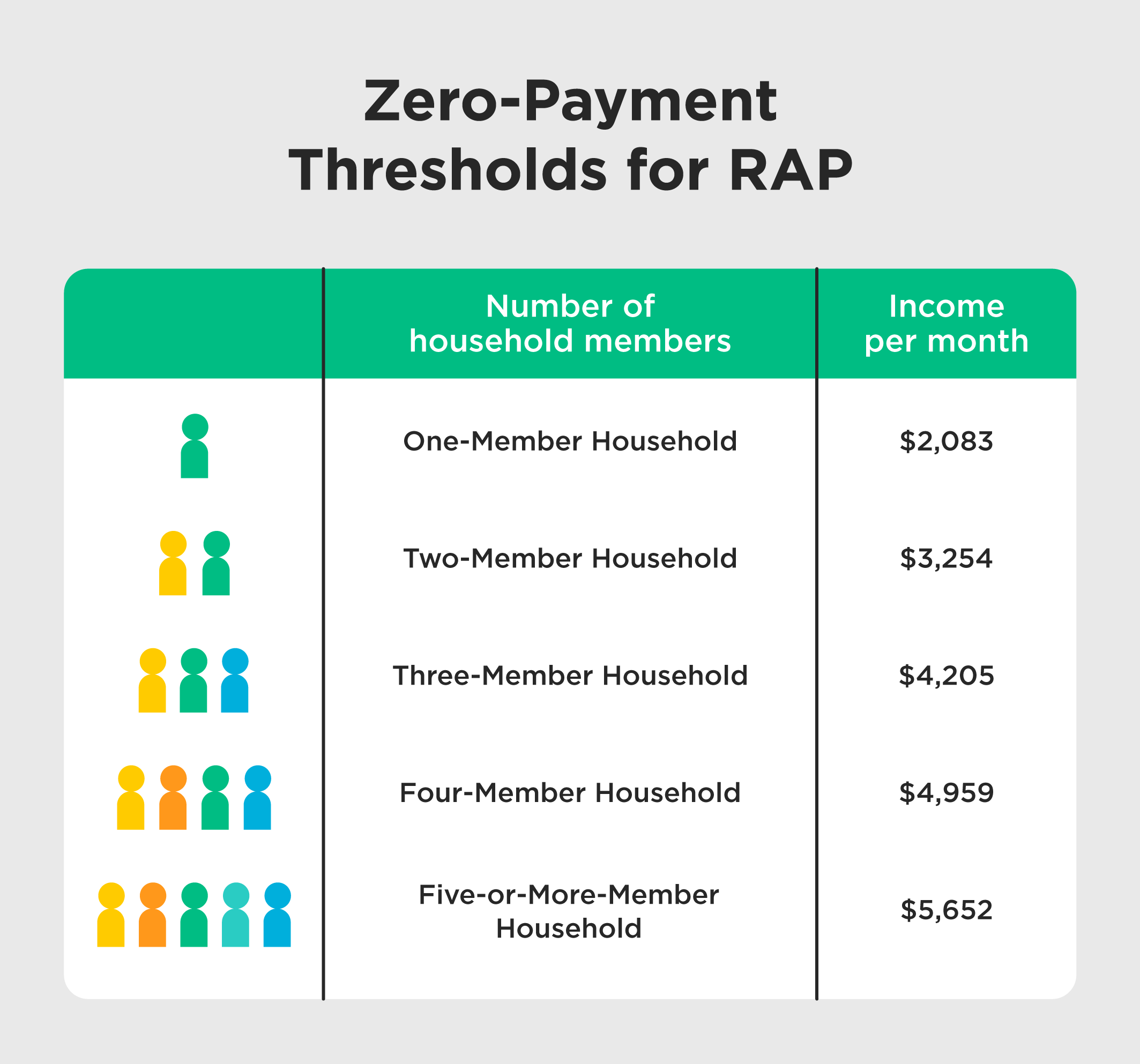

The amount you receive will depend on your income and your family size. If your gross family income per month falls under the below thresholds, you won’t be expected to pay on a monthly basis: The thresholds for zero payment are:

If your household income is above these thresholds, that doesn’t mean you don’t qualify for loan reductions. The amount you pay will simply be adjusted to reflect your gross household income.

Additionally, as of November 2022, the zero-payment threshold for individual borrowers increased from $25,000 to $40,000, meaning individual borrowers in RAP won’t have to begin payment until they make $40,000 a year.

Since Canada doesn’t have universal student loan forgiveness, you may have to take more drastic measures to relieve student debt if you fall under financial hardship. If you find yourself unable to pay your debts, submitting a consumer proposal or declaring bankruptcy are options you can consider.

A consumer proposal is a legal process where you work with a Licensed Insolvency Trustee to form an offer to your creditors to pay a percentage of your debt or extend the time you have to pay your debt — or sometimes both.

If your proposal is accepted, you’ll be able to retain your assets as long as you adhere to the conditions of the proposal. If denied, you’ll either have to submit a new proposal or look into other options, such as bankruptcy.

Bankruptcy often becomes an option after losing your job or falling into another financial hardship. If you decide to declare bankruptcy, you should:

If you submit a consumer proposal or file for bankruptcy at least seven years after you complete your program, your student loan debts will be eligible for discharge. In situations where hardships can occur before the seven-year threshold, a court can reduce the timeframe under the hardship provision.

You never expect moments of financial hardship to arise, but when they do, it’s important to know what your options are. Declaring bankruptcy is a difficult step to take, but it may be worth considering in situations where you feel overburdened by student loan debt.

Federal funding isn’t the sole way for student borrowers in Canada to pay less on loans — there are also a variety of provincial repayment plans available to you.

These programs include:

| Program | Description |

|

The Province of British Columbia will forgive student loan debt at a rate of 20% per year for up to 5 years, |

|

|

This plan ensures the amount you pay will never exceed 20% of your income. |

|

|

New Brunswick eliminated interest on the provincial part of student loans in late 2022. |

|

|

Nova Scotian students graduating from undergrad programs can receive 5 years of loan forgiveness, or up to $20,400. |

|

|

The act gives eligible students $3,500 per year to put towards their student loans. |

|

|

The Quebec government forgives 15% of anyone’s student loan debt. |

|

|

Saskatchewan Loan Forgiveness for Nurses and Nurse Practitioners |

Nurses and Nurse Practitioners can get 20% of their outstanding loan amount forgiven. |

Student loan forgiveness in Canada can be difficult to understand, so it’s natural to have lots of questions surrounding a complex topic. Here are some of the most common questions we hear from students and the answers we provide.

Unless you’re a medical professional who fulfills the specific criteria for eligibility, your student loans cannot be forgiven. To receive assistance paying your student loans, you’ll need to enroll in a federal student loans repayment program, like RAP, or a provincial repayment plan.

Government loans cannot be written off. If you’re unable to pay your loans and miss nine consecutive months of payments, your loans go to the Canadian Revenue Agency for collection.

If you can’t pay off your student loans, you’ll have to declare bankruptcy. Bankruptcy only relieves you of your student loan obligations if you declare seven years after you finished your program.

If you miss nine consecutive months of payment, your federal loans are sent to a Canadian Revenue Agency for collection. Once your loans are in collection, you won’t be able to file for student aid again until your loans are up to date.

Private student loans, like those from banks or other private institutions, are not eligible for forgiveness. Only federal student loans are eligible for forgiveness.

If you’re nearing the end of your program and looking to enroll in a repayment plan like RAP, a Financial Administrator at Robertson can equip you with the knowledge you need to begin the process.

While it can be scary to look at your debt obligations after you graduate, know that there are many options available to help relieve your financial stress.

If you have questions about the student loan repayment process, reach out to Tuition Fee Funding & Assistance today.

In This Article

Once you take the first step, one of our Student Admissions Advisors will get in touch to better understand your goals for the future.

Apply Now