What Do Finance Jobs Pay? 19 Entry-Level Jobs (2023)

quick answer

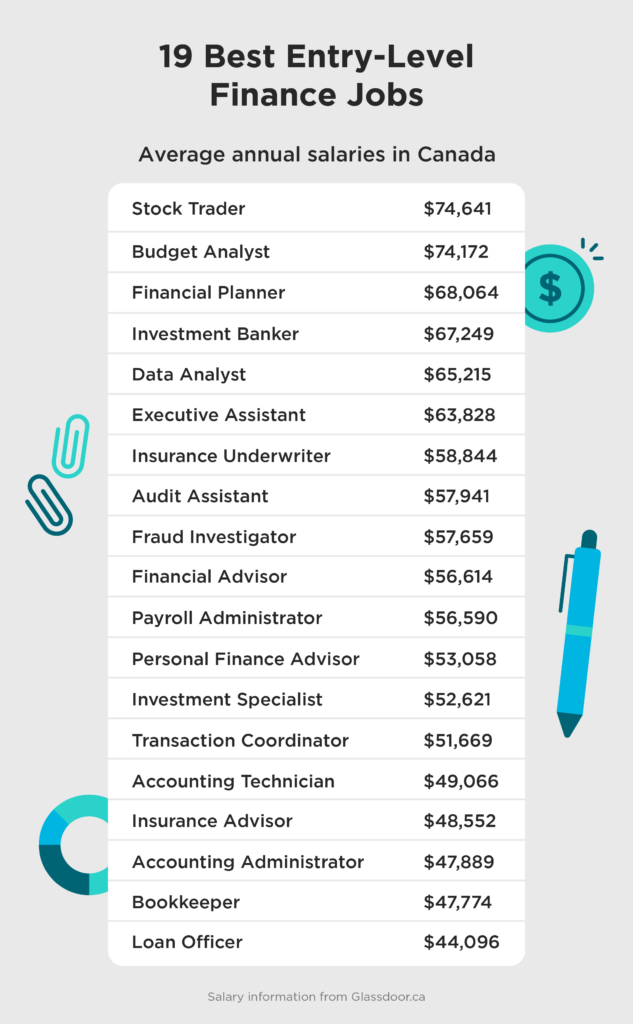

The average Canadian salary for an entry-level finance job is $57,660. For entry-level work, the lowest salary is Loan Officers at $44,096, and the highest salary is Stock Traders at $74,641.

In This Article

Show me the money! Jobs in finance can be exciting, demanding, and well-compensated. That’s why there are so many movies about this particular industry. Drama and comedy aside, this is a dynamic field with many great opportunities. And employers need employees with the right combination of business education, skills, and experience.

So, what do finance jobs pay? The average Canadian salary for an entry-level finance job is $57,660. The lowest average salary is Loan Officer at $44,096, and the highest average salary is Stock Trader at $74,641. One of the highest-paying non-entry-level jobs in finance is Chief Financial Officer, with an average salary of $179,007. This is a pretty big range. But everybody has to start somewhere before they land a high-paying position.

Here, we’ll explore the best entry-level finance jobs in Canada. We’ll show you the range of salaries, job duties, and necessary skills. Use this information to inform your career path in the financial industry.

Average Annual Salary: $44,096

Education Required: Post-Secondary Diploma, Certificate, or Degree

Average Time to Complete: 6 weeks–4 years

It’s a great feeling to help people reach a goal! Loan Officers work for financial institutions like banks, mortgage brokers, credit unions, or student loan agencies. They help customers get approval for their loan applications. Loan Officers help customers to reduce rates, lower fees, and get the best loan possible.

Loan Officers are skilled in:

Average Annual Salary: $47,774

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Any business that deals with money needs a Bookkeeper. They keep track of daily financial transactions for businesses in many industries. Bookkeepers must also check for discrepancies, confirm legal requirements, create reports, and collaborate with accounting.

Bookkeepers are skilled in:

These skilled workers are vital to the day-to-day operations of business across Canada. Our Administrative Assistant / Bookkeeper Diploma Program gives students the essential skills for bookkeeping, office organization, and accounting software.

Average Annual Salary: $47,889

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 1–2 years

The Accounting Administrator is like an Accountant mixed with a Bookkeeper. They generally work for large companies with multiple Accountants. Alongside bookkeeping duties, the Accounting Administrator can run payroll, prepare taxes, manage invoices, monitor petty cash flow, and communicate with many people.

Accounting Administrators are skilled in:

Earn your Accounting and Payroll Administrator Diploma to gain the necessary skills for bookkeeping, Sage/Quickbooks software, and payroll administration. Canadians should choose a program that is affiliated with the National Payroll Institute.

Average Annual Salary: $48,552

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Insurance Advisors help simplify the complex process for their clients who need insurance. On behalf of their employer, Insurance Advisors analyze clients’ risks, financial needs, taxes, and options for insurance. They use this information to give insurance advice tailored to the client’s needs. The main goal is finding the best insurance solution for all parties.

Insurance Advisors are skilled in:

Average Annual Salary: $49,066

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Accounting Technicians can be self-employed or work for a business. They’re more specialized than Accountants but share many of the same skills. These financial professionals get into the detailed parts of organizing payroll, dealing with vendors, verifying financial processes, and filing important documents.

Accounting Technicians are skilled in:

Joining an Accounting Technician Diploma Program can help you stand out from the crowd with skills in bookkeeping, budgeting, accounting software, and communication skills.

Average Annual Salary: $51,669

Education Required: Post-Secondary Diploma or Certificate (Preferred)

Average Time to Complete: 12 Months

Buying or selling property involves a lot of work and people. That’s where Transaction Coordinators come in! In the real estate industry, they help manage schedules, deadlines, paperwork, and the closing process. Transaction Coordinators are organized people who thrive under pressure.

Transaction Coordinators are skilled in:

Average Annual Salary: $52,621

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

If you like to help people make the most out of their money, you should become an Investment Specialist. These financial professionals work with clients on behalf of financial institutions. They advise clients on their investments, such as retirement savings, real estate, stocks, bonds, and other securities. Investment Specialists are savvy decision-makers who work well independently and with others.

Investment Specialists are skilled in:

Average Annual Salary: $53,058

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

As the name implies, Personal Finance Advisors help people make smart decisions with their finances. They can work for financial institutions or be self-employed. Personal Finance Advisors help people manage their investments, savings, taxes, and bills. Best of all, they help people achieve financial goals for retirement, schooling, marriage, and more.

Personal Finance Advisors are skilled in:

Average Annual Salary: $56,590

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Payroll Administrators can work for any business that pays people. Payroll Administrators keep detailed records of employee information like work attendance, overtime, and benefits to determine pay. They also account for deductions such as employment insurance (EI), union dues, provincial taxes, and Canada Pension Plan (CPP) contributions.

Payroll Administrators are skilled in:

Robertson College’s Accounting & Payroll Administrator Diploma Program will give you the skills and experience for a successful career. Get trained on Sage and QuickBooks in a program affiliated with the National Payroll Institute.

Average Annual Salary: $56,614

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

In finance, you don’t just work with money — you work with people. Financial Advisors work with clients on behalf of banks, investment companies, and other financial institutions. They use research and financial expertise to create strategies for their clients. There is a high demand for Financial Advisors in Canada due to many professionals approaching retirement age.

Financial Advisors are skilled in:

Average Annual Salary: $57,659

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Fraud Investigators thrive on new challenges that test their skills. Fraud Investigators can work for banks, insurance companies, police, and many other industries. They investigate allegations, interview people, research evidence, and provide analysis. Fraud Investigators don’t need specific post-secondary education, and every province has license requirements.

Fraud Investigators are skilled in:

Average Annual Salary: $57,941

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

Audits establish credibility, both to stakeholders and government agencies like the Canada Revenue Agency (CRA). Audit Assistants can work for firms or businesses with large financial management concerns. They ensure businesses comply with regulations by analyzing records and making recommendations with their team.

Audit Assistants are skilled in:

Average Annual Salary: $58,844

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Insurance Underwriters work on behalf of insurance companies. They review applications, assess the risk potential, and make recommendations for coverage. Insurance Underwriters work with lots of people, and sometimes it can be stressful work. It’s important to have advanced accounting and interpersonal skills.

Insurance Underwriters are skilled in:

Average Annual Salary: $63,828

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Jobs in finance can be dynamic and exciting too. Executive Assistants do essential work for Financial Executives across all industries. These skilled workers manage office duties and support Executives in their work. Executive Assistants deal with clients, manage projects, draft reports, and more.

Executive Assistants are skilled in:

Delivered 100% online, Robertson College’s Executive Assistant Diploma gives you the flexibility you need to pursue an in-demand career in finance.

Average Annual Salary: $65,215

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

This is an in-demand business job in today’s data-driven world. Data Analysts do important work for finance departments in many industries. Financial Data Analysts help organizations interpret data and create data management solutions. They collect important data and present valuable insights to coworkers.

Data Analysts are skilled in:

Individuals who want to gain specialized skills and pivot their careers should consider our online Data Analyst Diploma Program.

Average Annual Salary: $67,249

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

This role is for people who thrive in a high-stakes environment. Investment Bankers work for large companies, banks, and insurance agencies. Canadian Investment Bankers work primarily in Toronto. They provide financial advice, manage company expansions, and gather significant funds.

Investment Bankers are skilled in:

Average Annual Salary: $68,064

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

Financial Planners help individuals create financial plans. Financial Planners have more advanced skills and knowledge than Financial Advisors. Considering their advanced expertise, Financial Planners usually work with high-net-worth Canadians.

Certification is required in some provinces. In Ontario, the FSRA approves the Financial Planner and Financial Advisor titles. And there are specific provincial regulations in Manitoba, Québec, and Saskatchewan.

Financial Planners are skilled in:

Average Annual Salary: $74,172

Education Required: Post-Secondary Diploma or Certificate

Average Time to Complete: 12 Months

Budget Analysts can work in many industries, including government and private businesses. They provide analysis of budgets and make thoughtful recommendations. Budget Analysts ensure budgets are complete, in line with provincial/federal regulations, and designed for success. Entry-level positions may require a College or University Diploma.

Budget Analysts are skilled in:

Average Annual Salary: $74,641

Education Required: University Degree or Post-Secondary Diploma

Average Time to Complete: 4 Years

Toronto might be the financial capital of Canada, but you don’t need to live there to work in finance. Stock Traders work in financial markets from offices and at home. On behalf of their clients, Stock Traders purchase and trade stocks, cryptocurrency, bonds, securities, and more. Canadians looking to trade securities need a Canadian Securities Course (CSC) Certificate.

Stock Traders are skilled in:

Jobs in finance are incredibly dynamic, and a Stock Trader will possess many different skills compared to a Payroll Administrator. But from a bird’s eye view of the industry, all finance professionals share specific skills, like:

Hiring Managers will want to see evidence of these skills. Prepare to explain your strengths and skills with real-life examples. Internships and practicums can be a great way to earn valuable experience that will impress during a job interview.

It helps to have support when building a resume, hunting for jobs, or preparing to nail an interview. Our Workforce team provides lifelong career support for Robertson students and graduates.

There are so many exciting entry-level opportunities in finance, from corporate to nonprofit. We’ve discussed a lot about entry-level pay. Now we’ll answer some questions about what finance jobs pay in general.

Finance jobs in Canada can pay very well. Entry-level finance jobs pay an average of $44,096 annually for the role of Loan Officer. Advanced finance jobs in Canada pay an average of $179,008 annually for the role of Chief Financial Officer.

The highest-paying entry-level finance job is Stock Trader. Stock Traders in Canada earn an average of $74,641 annually. The second highest-paid entry-level finance job in Canada is Budget Analyst, with an average salary of $74,172.

The highest-paid job on Wall Street is the Chief Financial Officer (CFO), with an average salary of $199,709 annually in New York. In Toronto’s Bay Street, the highest-paid position is CFO, with an average salary of $200,850.

The highest-paying Finance job is Chief Financial Officer (CFO), with an average salary of $179,007 in Canada. The highest-paid CFO position earns a salary of $1,045,114.

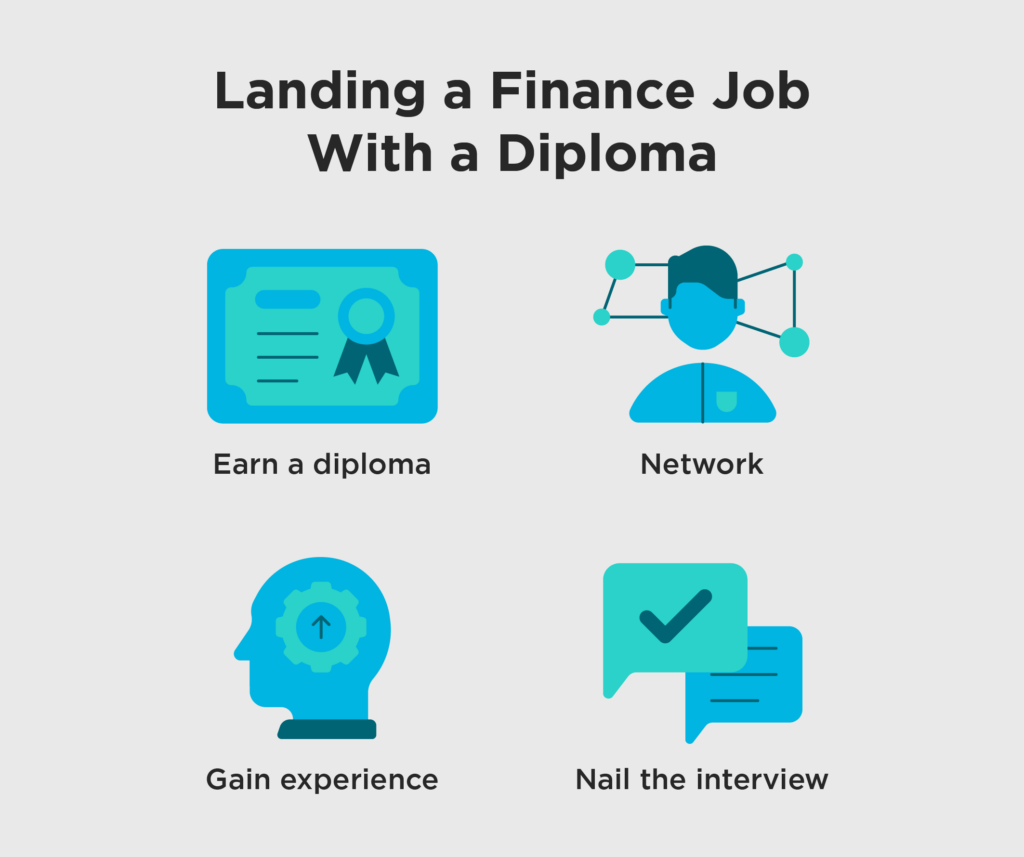

Many finance jobs don’t require specific Diplomas, Certificates, or Degrees. But there are expectations regarding skills and experience. Earning an Executive Assistant or Bookkeeper Diploma can lead to work supporting leadership roles in finance.

You can get hired in finance with a combination of education and hard work. Here are the basic steps for getting a finance job with a Diploma.

This can be an exciting industry for career hopefuls, especially considering what finance jobs pay. Professionals who want to pivot to finance can develop specialized skills with post-secondary education. Canada’s job market is growing, and entry-level positions are a great way to break into the financial services industry.

Join Robertson’s School of Business and start working towards your career in finance today.

In This Article

Once you take the first step, one of our Student Admissions Advisors will get in touch to better understand your goals for the future.

Apply Now